Earlier this year, College Possible CEO and founder Jim McCorkell wrote an essay about the continued importance of college degrees in a climate that increasingly questions their value and impact. And last month, we published a piece about the economic impact of degree holders in cities around the country. Each of these pieces, coupled with a growing body of research, demonstrates that a post-secondary education is, for all Americans and particularly for those coming from low- and moderate-income backgrounds, required for middle class life in the coming decades.

And yet, the risk calculus of embarking on a college education keeps changing and increasing for all families, but especially those who can’t pay the full cost of college out-of-pocket. The net cost of college to families keeps going up. Student loan debts are dramatically increasing. A new study shows that even the jobs students secure to help pay for college are different by income level, and can threaten low-income students’ ability to graduate. And there is an inverse relationship between a students’ ability to get into a college and the likelihood of their graduation four to six years later. The types of institutions that most low-income students enroll in – because they admit most students and charge relatively little – tend to record graduation rates that border on shocking in some cases. Meanwhile, the colleges that routinely graduate most of their students tend to be the hardest to get into, even among public flagship institutions. This type of risk-reward calculation is typically reserved for financial planners and even Wall Street types; how is your average family of modest means to make an informed decision?

With the support of the U.S. Treasury Department’s Financial Innovation Fund, College Possible set out to test a hypothesis: With a targeted curriculum, use of publicly available financial tools and access to a near-peer AmeriCorps coach who provides mentoring and coaching to students and their families, we could improve students’ financial literacy and the ways they make good financial decisions about colleges.

Informing Financial Decisions

While many people believe the way to help students and families make better, more informed decisions is to create new tools, new technologies or new resources, our hypothesis – based on a couple of decades in the field – is that there is no shortage of these things. There are many curricula out there, created by financial institutions, nonprofit organizations or higher education institutions, and many of them are quite good. Choosing one is more a matter of target audience and program design than finding a “better” or “worse” tool. There are also government resources, everything from college scorecards to financial shopping sheets to FAFSA application support materials, all designed to help families make informed decisions. Tools and resources abound; the question is whether students and families know where to find them, how to use them and whether to trust them. By providing a near-peer coach to help find and make sense of what’s available, we believe we can make a difference for our students.

Following on that belief, we followed a group of students in our program for three years, from the day they signed up to the end of their first year in college, to see what they learned. Here are some of our key findings:

Following on that belief, we followed a group of students in our program for three years, from the day they signed up to the end of their first year in college, to see what they learned. Here are some of our key findings:

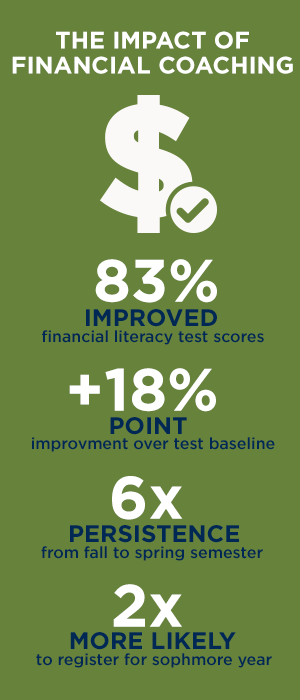

- Students improved their financial literacy. 83 percent of students in the program improved their financial knowledge, and those who attended at least 75 percent of financial coaching sessions improved their financial test scores by almost 20 percentage points over the baseline.

- Students made good financial decisions about enrolling in college. Those who attended more financial literacy sessions applied for more scholarships; applied to fewer colleges but were accepted at a higher rate, indicating they targeted their applications at the right institutions; and completed pre-enrollment paperwork at a higher rate.

- Students gained confidence in their ability to make good financial decisions about college. High school students reported feeling more confident and prepared to make financial decisions about college that reflected their increased learning. Perhaps even more importantly, once they arrived in college, continued coaching helped students feel they understood financial topics, were prepared to make even difficult financial decisions and raised their confidence that they belonged in college.

Enhancing Persistence

Ultimately, this coaching support was linked to college persistence, as students who continued to receive coaching in college were six times more likely to persist in college from fall to spring, and more than twice as likely to register for classes the following year as their non-participating peers.

While this is all very promising, we note several important next questions for College Possible and for the field.

First, these findings, while positive, are limited by the nature of the study, which did not involve a comparison group. Without that, it is hard to know for sure whether the coaching students received and the materials we relied on actually helped change outcomes, though other studies do support the idea that coaching has an impact on college enrollment.

Second, what difference does better financial decision-making about college really make? At College Possible, our goal is for students to earn a college degree at as low a cost as possible, but many times, those criteria come into conflict. Is it a good financial decision to avoid student loans if it means you must pay out-of-pocket and take eight or ten years to earn a degree? Is it a good financial decision to attend a college with great financial aid if it takes you away from the vital community supports you need? Organizations, and the field, need better ways of explaining what a “good” financial decision is in the context of pursuing a college degree.

Finally, it’s clear that better financial decision-making only goes so far without actual dollars available to students. While students report feeling confident they belong in college and confident in their ability to make good financial decisions, by far the biggest driver of decisions on where to enroll in college was finances (65 percent of students indicated they felt the cost of attendance was very or extremely influential when making their decision to attend a college).

Likewise, once students were enrolled in college, the vast majority of students (68 percent) indicated concern about how they would continue to pay for college, with fully half of students worrying specifically about the amount of student loans they might need to take out and a sizeable minority of students questioning their ability to remain enrolled because of the financial resources available to them (for example, 9 percent of students at the end of one year of college expressed concern that they may have to decide between financially supporting their family and staying in college). Students who believe they belong in college and who feel they can make good financial decisions may nonetheless be stopped from persisting if they simply don’t have enough resources to pay their bills. Indeed, they may decide the best financial decision is to drop out.

The challenge identified by the U.S. Treasury Department is real. Indeed, many students and families from low-income backgrounds do not have the knowledge to navigate the complicated financial decisions involved in pursuing higher education. But many of the tools are in front of us, and a growing body of evidence supports the idea that knowledgeable guides, such as those provided by AmeriCorps to College Possible, can help access and understand the right curriculum and the publicly available tools that can help guide decision-making. Nonetheless, until we address the broader issue of spiraling college costs, financial literacy alone isn’t enough to change college-going patterns, rates and outcomes for low-income communities.

You can read the Treasury Report Research Brief here.

by Traci Kirtley